Boeing, Exxon, Apple join the Western companies that reject Russia because of Ukraine

March 2 – Boeing (BA.N) suspends support and technical support for Russian airlines and US energy company Exxon Mobil (XOM.N) has said it will leave Russia, joining a growing list of Western companies rejecting Moscow because of its invasion of Ukraine.

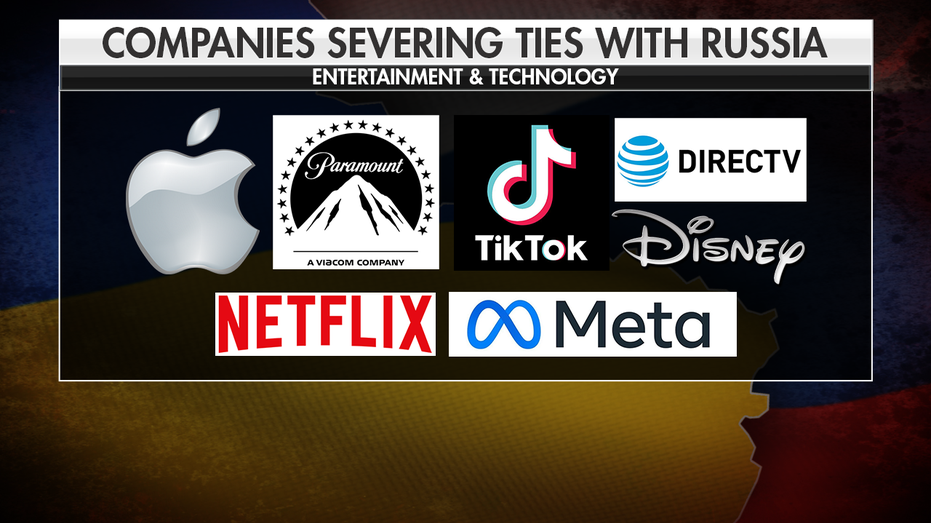

US technology giant Apple (AAPL.O) has said it has stopped selling iPhone and other products in Russia, while Ford Motor (FN) has joined other carmakers by shutting down operations in the country.

Western countries have steadily tightened sanctions against Russia since it invaded Ukraine last week, including the exclusion of some Russian banks from the global financial network SWIFT.

The measures hit the ruble and forced the central bank to raise interest rates as Moscow responded to the growing exodus of Western investors by temporarily restricting sales of Russian assets by foreigners.

Meanwhile, Russian companies are feeling increasingly pressured. Sberbank (SBER.MM), Russia’s largest lender, said on Wednesday it was leaving the European market as its subsidiaries face large cash flows. In addition, it is said that the safety of employees and their property is endangered. Read more

Signaling that there will be no concessions from the West, US President Joe Biden said in a statement on the state of the Union on Tuesday that his Russian counterpart Vladimir Putin “has no idea what lies ahead” as he joined European countries and Canada in closing of US airspace to Russian aircraft. Read more

As international freight forwarders such as Maersk (MAERSKb.CO), Hapag Lloyd (HLAG.DE) and MSC suspend reservations to and from Russia, the country is becoming increasingly excluded from world trade. Sanctions are also putting pressure on Russia’s aviation sector.

Boeing said on Tuesday it was suspending operations as other airlines faced growing European and US restrictions on relations with Russian customers, affecting leasing aircraft, exporting new aircraft and providing parts.

CHOIR OF CONVICTION

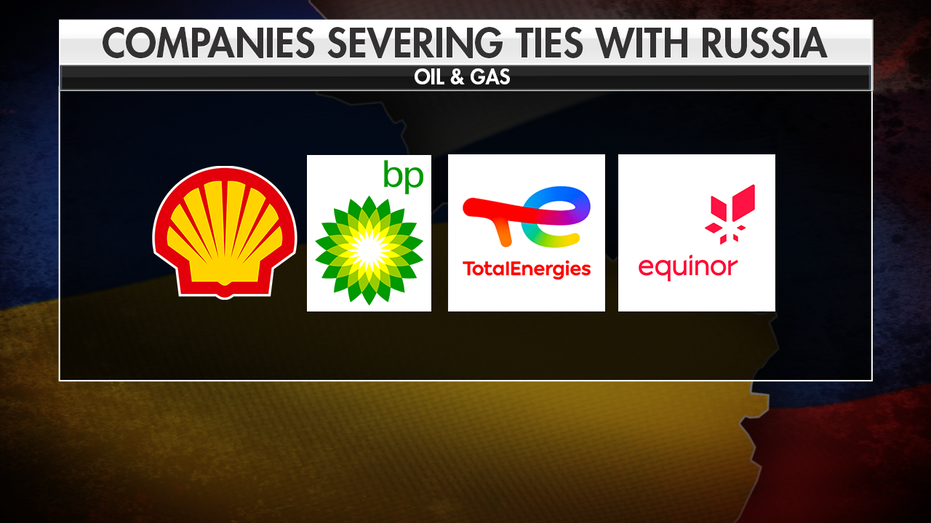

Exxon has said it will not invest in new developments in Russia and is taking steps to exit the Sakhalin-1 oil and gas plant after similar actions to dump assets from Britain’s BP, Russia’s largest foreign investor, and Shell Plc ( SHEL.L).

However, the French company TotalEnergies (TTEF.PA) stopped saying it would leave Russia, only saying it would not deposit new money. Read more

Apple Store Logo in Washington, DC, USA, January 27, 2022. REUTERS / Joshua Roberts

Apple, which has stopped sales in Russia, said it was making changes to its Maps app to protect civilians in Ukraine.

He also joined a growing chorus of Western companies that openly condemned Russia’s actions.

“We are deeply concerned about the Russian invasion of Ukraine and are with all the people who are suffering as a result of the violence,” Apple said.

“We deplore Russia’s military action, which violates Ukraine’s territorial integrity and threatens its people,” Exxon said, while Ford said in his condemnation: “The situation has forced us to re-evaluate our operations in Russia.”

Motorcycle manufacturer Harley-Davidson Inc has stopped deliveries of its bicycles to Russia.

The growing focus of investors on environmental, social and governance (ESG) issues has added pressure on companies to act quickly to sever ties with Russia and Russian businesses.

“The only way for many to act is to sell,” said TJ Kistner, vice president of Segal Marco Advisors, a major U.S. retirement consultant.

Major Western technology companies have said they are continuing their efforts to stop Russia from taking advantage of their products.

Apple says it has blocked the download of applications from some state-sponsored news services outside Russia.

Google, owned by Alphabet Inc. (GOOGL.O), said it had blocked mobile apps linked to Russian state-owned publisher RT from its news-related features, including Google News search.

Google has also banned RT and other Russian channels from receiving money for ads on YouTube websites, applications and videos, reflecting a move made by Facebook (FB.O).

Microsoft (MSFT.O) has said it will remove RT’s mobile apps from its Windows app store and ban ads in Russian-sponsored media.

Report by Paresh Dave in Auckland, Ross Kerber in New York, Dawn Khmelevsky in Los Angeles; Writing by Peter Henderson and Sayantani Ghosh; Edited by Lincoln Fest and Edmund Blair

Our standards: ‘ principles of trust.

Boeing, Exxon, Apple join the Western companies that reject Russia because of Ukraine Read More »

The company Nexon announcing that he was the founder, Jungju Kim (equal to the name of Jay Kim) was the one who passed. It is 54 years old.

The company Nexon announcing that he was the founder, Jungju Kim (equal to the name of Jay Kim) was the one who passed. It is 54 years old.