Jeep maker Stellantis aims to double its revenue by 2030

Chris Foyel, CEO of Stellantis ‘Chrysler brand, presented the all-electric Chrysler Airflow Concept during Stellantis’ CES 2022 press conference at the Las Vegas Convention Center on January 5, 2022 in Las Vegas, Nevada.

Alex Wong | Getty Images

Stellantis, formerly known as Fiat Chrysler, intends to double its net revenue to 300 billion euros ($ 335 billion) by 2030, CEO Carlos Tavares announced on Tuesday.

The carmaker plans to do so while maintaining a double-digit operating profit margin as it largely shifts to all-electric vehicles, Tavares said during an investor presentation outlining Stellantis’ 2030 business plans.

The plans reflect those of other major carmakers such as Volkswagen and General Motors to remain profitable as they switch to all-electric vehicles. The transitions are moving from increasingly stringent global emissions regulations and the rise of Tesla to the world’s most valuable carmaker by market capitalization.

Stellantis – the world’s fourth-largest automaker – plans to expand its software business and services and sell 5 million all-electric vehicles by 2030, including all passenger car sales in Europe and 50% of U.S. passenger cars and light commercial vehicles.

“We are moving and moving fast to be a mobility technology company,” Tavares said during the event.

The carmaker plans to generate more than 20 billion euros ($ 22.3 billion) in industrial free cash flow in 2030. It is also aiming for a dividend payout ratio of 25% to 30% and intends to buy back up to 5 % of open ordinary shares by 2025

Stellantis plans to be carbon neutral by 2038, with a 50% reduction by 2030, the company said.

The announcements did not help much for the company’s shares. Shares of Stellantis on the New York Stock Exchange fell about 4% on Tuesday morning to $ 17.50 per share. The company’s shares have risen by about 10% since the merger.

Stellantis was created by merging Fiat Chrysler and France-based Groupe PSA in January 2021. It has 14 separate car brands, including Alfa Romeo, Chrysler, Dodge, Fiat, Jeep and Peugeot.

Stellantis will launch Jeep’s first all-electric SUV in early 2023. The company unveiled the car on March 1, 2022, during Investor’s Day.

Stelantis

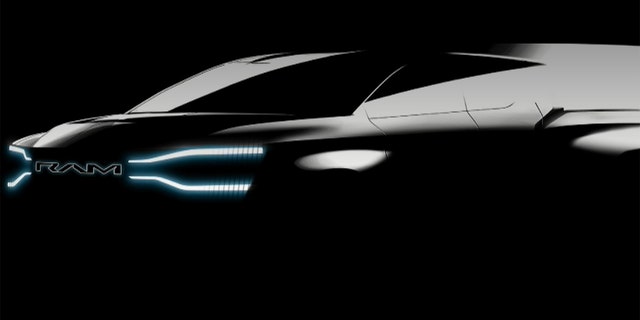

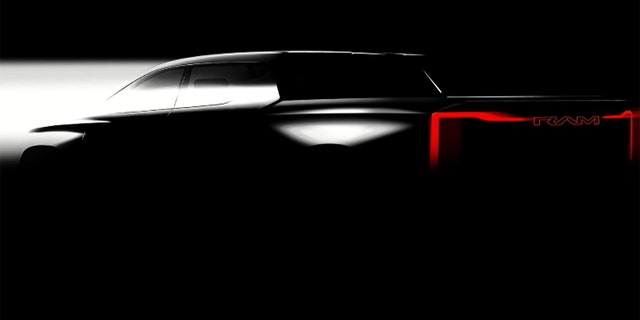

The automaker plans to launch at least 25 new all-electric vehicles in the United States by 2030, Tavares said. Among the first will be a small SUV Jeep next year and a muscle car Dodge and pickup Ram by 2024. Globally, the company expects to offer more than 75 EVs by 2030.

Stellantis is investing € 30 billion ($ 34 billion) in electric vehicles and technology support by 2025.

The company’s electrification strategy in the short term differs from other car manufacturers. It still plans to launch plug-in hybrid electric vehicles or PHEVs in the coming years. PHEVs combine electrical systems and batteries with internal combustion engines.

Jeep maker Stellantis aims to double its revenue by 2030 Read More »