text size

WWE takes over. Investors should be happy, but they probably wanted an easier deal.

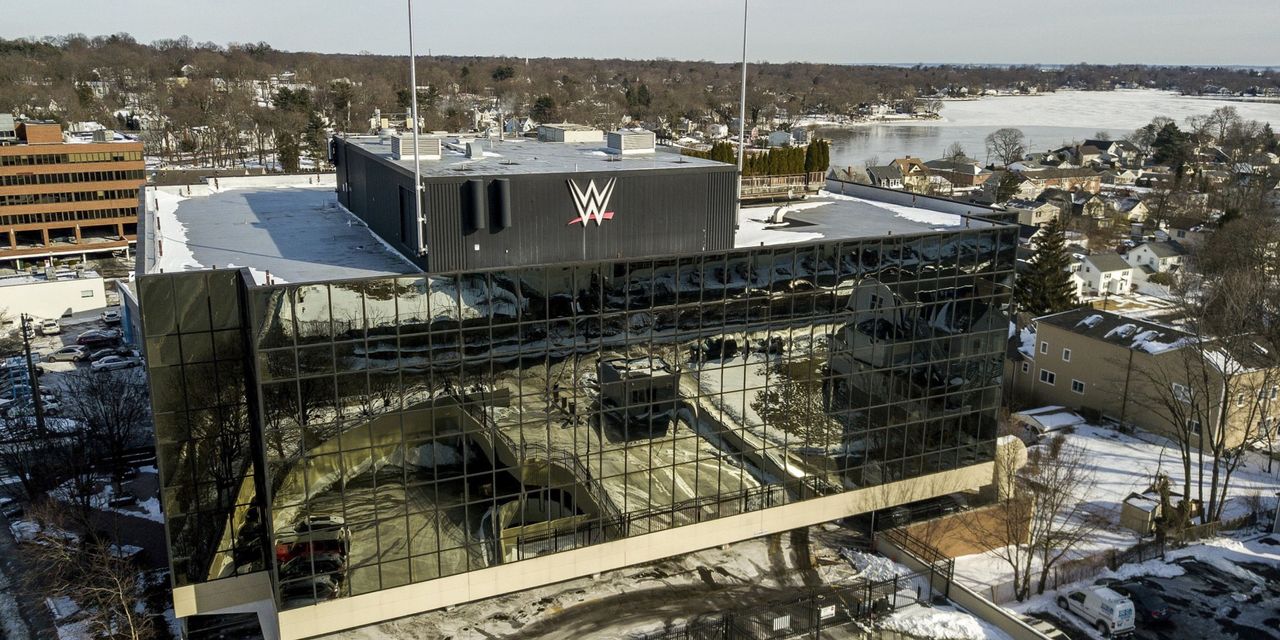

Johnny Milano/Bloomberg

A merger between World Wrestling Entertainment and the company that owns UFC has landed in one fell swoop.

Shares of WWE (Ticker: WWE) fell 4.9% in midday trade on Monday after the company announced it will merge with mixed martial arts company Ultimate Fighting Championship, part of Endeavor Group (EDR ) is. Endeavor stock lost 7.2%.

WWE and Endeavor said they plan to create a new company controlled by Endeavor for the merger.

Investors have been betting heavily on changes at WWE this year after the company announced on Jan. 6 that it is exploring strategic alternatives to maximize value for WWE stakeholders.

Investors likely wanted WWE to be acquired for a huge bounty. Between January 5th and March 31st, WWE stock rose approximately 27%. The S&P 500 rose about 8% over the same period.

WWE has come up with a strategic alternative, one that values the company at $9.3 billion, much higher than the $7.8 billion value WWE traded on Monday. UFC is valued at $12.1 billion, according to the companies.

No stock or cash will be given to WWE shareholders, which would value WWE at $9.3 billion. This rating is just an idea. As part of the deal, WWE stock will continue to trade under the new stock symbol “TKO” and is just a larger company. For WWE owners, it brings WWE more management and business diversification.

Endeavor shares will also continue to trade. It will own TKO stock as well as its other businesses, which include live sports like the Miami Open tennis tournament.

Together, UFC and WWE generate approximately $1 billion in earnings before interest, taxes, depreciation or amortization, or Ebitda. About $600 million of that comes from UFC. The other $400 million comes from WWE.

Based on where WWE is trading on Monday, the market values the combined company at around 18 times Ebitda. The S&P 500 trades at around 12.4 times Ebitda. The Nasdaq Composite Index trades at around 16.7 times Ebitda.

The new companies will still be more expensive than the average for companies in both indices.

Investors must decide if there are enough cost savings and increased growth for the new company to justify the premium.

Initial returns from Wall Street are positive as Jefferies analyst Randal Konik thinks the deal is good.

“The UFC is in the early stages of its growth trajectory, and Endeavor’s expertise in esports, marketing and live events can incrementally enhance WWE’s fundamentals,” the analyst wrote in a report Monday.

He covers Endeavor stocks and rates stocks to buy. The price target is $41 per share, up 84% from the current price of about $22.20 per share. Endeavor generates approximately $600 million in non-UFC EBITDA. That means he’s valuing the new Endeavor at around 19x Ebitda.

He believes in growth. Investors are still trying to figure out what they think.

Write to Al Root at [email protected]