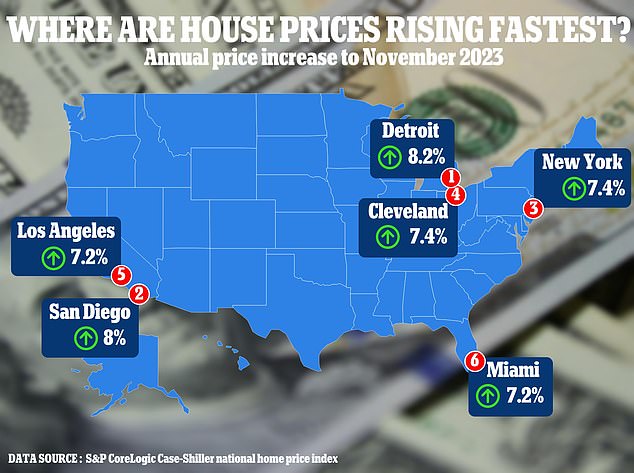

Home prices in Detroit are rising the fastest in the country as the city recovers from the mortgage crisis that left some homes virtually worthless.

In the year ending November 2023, home prices in the Motor City rose 8.2 percent, according to the latest data from the leading U.S. home price gauge.

Meanwhile, prices in San Diego rose 8 percent year-over-year – the second largest of any city.

Homes in New York City and Cleveland rose 7.4 percent annually, while home prices in Los Angeles and Miami rose 7.2 percent through November 2023. Scroll down to see the full list.

Although markets in these cities are still red-hot, home prices across the country actually began to cool in November after nine straight months of gains, the data showed.

In the year ending November 2023, home prices in Detroit rose 8.2 percent, according to the latest data from the leading gauge of U.S. home prices

According to the S&P CoreLogic Case-Shiller national home price index, the total cost of homes has fallen 0.2 percent since October 2023 – the first decline since January 2023.

This came at a time when mortgage rates were at their peak – the average 30-year fixed-rate loan was almost 8 percent as of October last year.

“The rate has fallen by over 1 percent since then, which could support further annual increases in property prices,” said Brian Luke, head of commodities, real and digital assets at S&P DJI.

According to the data, prices nationwide were still higher than last year despite the monthly lull. From November 2022 they rose by 5.1 percent.

This came after a separate report found that real estate prices in Detroit rose the fastest than any other city in the US.

Less than two decades ago, one in five homes in the city were vacant, foreclosures were on the rise, and properties on deserted streets were selling for $1.

The mortgage crisis and the decline of major automobile manufacturers – which had made Detroit an industrial center – forced millions of people from their homes.

While real estate prices are now rising rapidly – because the auto industry is booming again, this time with electric vehicles – the city is still one of the cheapest in the US.

Median home prices are less than $200,000, and the Zillow marketplace lists properties with up to nine bedrooms for sale for less than $125,000.

This 5,200 square foot home with a whopping nine bedrooms and eight bathrooms is currently listed on the real estate market for just $124,900.

This nine-bedroom, eight-bathroom home is currently listed in Detroit for $124,900

According to Selma Hepp, chief economist at CoreLogic, Detroit has lagged behind other cities in terms of housing price growth, so some of that growth will have to catch up.

Electric vehicle research and development concentrated in Detroit is one of the reasons for the price increases, said CoreLogic chief economist Selma Hepp

“The region has had some success in securing investment for future production and particularly electric vehicle research and development, and the real average wage growth rate was twice the national pace between 2022 and 2024,” she said.

“This has helped strengthen the purchasing power of consumers in the region.”

The big three automakers — General Motors, Ford and Jeep maker Stellantis — are all based in Detroit, putting the company back at the forefront of auto production in the U.S. — and particularly the growing electric vehicle industry.

Across the country, the market remains hot as pent-up demand drives up costs.

Rising mortgage rates virtually shut down the market for millions of Americans in the second half of last year. , coupled with a historic decline in supply, continued to drive prices higher.

The mortgage crisis and the bankruptcy of major automakers have forced millions of people out of their homes in Detroit (Image: Abandoned properties in 2015)

But this year, experts are predicting an upswing in the market and price declines finally beginning.

NAR chief economist Lawrence Yun told earlier this year: “Mortgage rates are significantly lower than they were two months ago, and more inventory is expected to come onto the market in the coming months.”

He added: “It is clear that the recent rapid rise in house prices over three years is not sustainable.”

“If price increases continue at the current pace, the country could be transformed into haves and have-nots.

“Providing today’s renters with a path to home ownership is critical.” “It requires economic and income growth and, above all, a continued expansion of housing.”

| metropolitan area | Price Nov 2023 | Change v. Nov 2022 |

|---|---|---|

| Atlanta | 241.91 | 5.9% |

| Boston | 322.73 | 7.1% |

| Charlotte | 271.05 | 7.0% |

| Chicago | 197.67 | 7.0% |

| Cleveland | 184.16 | 7.4% |

| Dallas | 292.41 | 1.7% |

| Denver | 311.96 | 1.5% |

| Detroit | 181.87 | 8.2% |

| Las Vegas | 284.64 | 2.1% |

| Los Angeles | 420.57 | 7.2% |

| Miami | 428.20 | 7.2% |

| Minneapolis | 234.35 | 2.7% |

| new York | 294.23 | 7.4% |

| Phoenix | 324.91 | 2.5% |

| Portland | 319.06 | -0.7% |

| San Diego | 416.36 | 8.0% |

| San Francisco | 343.59 | 2.0% |

| Seattle | 363.85 | 1.6% |

| Tampa | 383.22 | 3.4% |

| Washington | 312.50 | 4.7% |

| Composite material-10 | 333.31 | 6.2% |

| Composite-20th | 318.24 | 5.4% |

| SOURCE: S&P Dow Jones and CoreLogic | ||