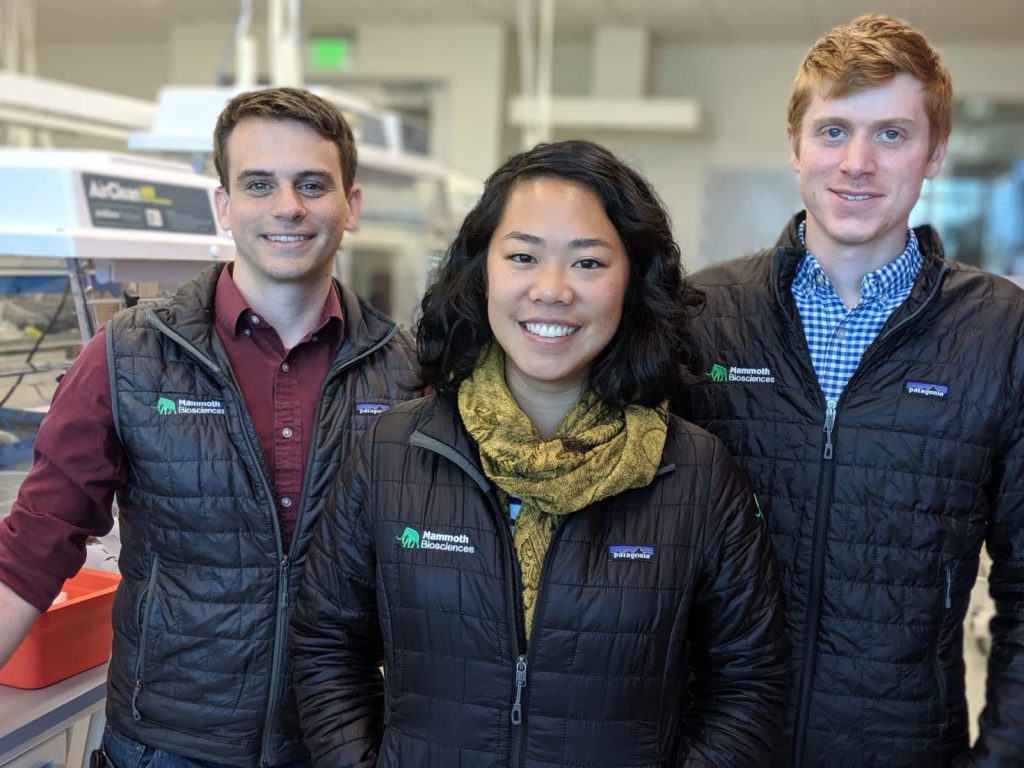

Janice Chen (center) and her Mammoth Biosciences co-founders Trevor Martin (left) and Lucas Harrington (right). CRISPR gene editing pioneer and Nobel laureate Jennifer Doudna is also a co-founder.

Along Highway 101 north of the San Francisco airport, a biotech startup called Mammoth Biosciences, co-founded by Nathan Chen’s sister Janice in 2018, is booming in the revolutionary field of CRISPR technology.

Although Chen is not as famous as her gold-medal skating brother or Mammoth co-founder Jennifer Doudna, who won the Nobel Prize in Chemistry for her work on CRISPR, Chen’s bioscience work in gene editing technology is in at the forefront of medical discovery. from detection of bacterial and viral infections to early detection of cancer.

CRISPR, or clustered short palindromic repeats at regular intervals, effectively cuts genomes and slices DNA to treat genetic diseases.

Outside of a small circle of colleagues, few knew that Nathan was her brother until she posted on social media about his gold medal while her family watched TV games from her home in San Francisco. Chen recalls being with her family in Seoul four years ago and watching him compete in the 2018 Winter Olympics. During breaks, she contacted lawyers to begin the process of creating a company.

Since the 2020 pandemic, the biotech startup has rapidly accelerated. The company has received about $100 million in contracts from Bayer and Vertex Pharmaceuticals and government grants, increased its workforce from 30 to 130, and is hiring at least 55 more people. Its valuation soared to $1 billion thanks to a $150 million venture capital deal last September that included Amazon, famed Silicon Valley venture capital firm Mayfield and Apple’s Tim Cook.

An exit strategy is not an acquisition, as Chen sees it.

“Our intention is not to build and sell it, but to become a $100 billion company in next generation CRISPR technology. There are so many opportunities for creativity and new technologies that could come from gene editing discoveries,” Chen said. “Defining the business strategy meant I needed to go beyond the lab and scale the company,” added Chen, who has been working remotely during Covid but is now back at the company’s headquarters in Brisbane, California, where there are pronounced green spaces. white colors. Elephant-shaped signs are clearly visible.

Roots of Salt Lake City, rise of Silicon Valley

Raised in Salt Lake City as one of five siblings (Nathan, 22, the youngest), her parents, Chinese immigrants in 1988, encouraged “we to reach our potential and become what is best for us,” — Chen, who is now 30 years old. , said. Chen learned to play the violin, participated in chess tournaments, and excelled at dancing. In chess competitions, where she was often the youngest and only woman, she said she learned “how to lose and how to win strategies”.

She discovered her passion for the biological sciences while working for her father’s small biotech business in Utah.

To relieve the stress of expanding Mammoth Biosciences, Chen recently started running in the San Francisco hills near her home. She quickly became comfortable with managerial tasks by reading The Founder’s Dilemma. She also sought the advice of a business coach, who helped determine “what kind of leader I want to be,” she said, adding, “I want to help myself and others reach their full potential. It’s about understanding each person’s motivations, what they want to try and learn, and making them part of the company’s ecosystem.”

Mammoth Biosciences is based on the underlying technology that Chen worked on at UC Berkeley’s Doudna Laboratory. Chen earned her PhD as a research graduate student in this hotbed of innovation.

As a mentor, Doudna encouraged Chen to start her own business after graduation rather than work for a major biotech company. “She told me I wasn’t shooting high enough,” said Chen, who holds academic degrees from Harvard Medical School and the Johns Hopkins Bloomberg School of Public Health and was a fellow at the HIV Research Institute in Durban, South Africa.

“She is a technical team leader and overall strategist with deep scientific knowledge and creativity and can see where this technology is headed,” said Doudna, whose UC Berkeley lab has been involved in an ongoing patent battle over biomedical ownership. technology. technology. The US Patent and Trademark Office recently ruled in favor of the Broad Institute, a partnership between MIT and Harvard University. This decision affects the licensing of several CRISPR companies, but does not cover the specific gene editing system that Mammoth Biosciences uses. Dudna is also a co-founder of the public company CRISPR Intellia Therapeutics.

At the age of 26, just after graduation, Chen set out to start a company with fellow student and lab researcher Lucas Harrington. They opened a store in a biotech incubator in San Francisco’s up-and-coming Dogpatch neighborhood. “Janice and I shared our time in the lab, prototyping, and raising venture capitalists,” Harrington recalled. Her husband, a San Francisco scientist whom she met at Johns Hopkins University, “understands the journey” and dedication to building this revolutionary company. “This is my life now,” she said.

More from CNBC’s Guide to Small Businesses

They met Mayfield partner Urshit Parikh through an association with Dudna. Parikh advised Stanford University graduate Trevor Martin on launching a diagnostic testing startup. A venture capitalist brought Martin, Dudna, Harrington, and Chen together to form Mammoth Biosciences. Martin is the CEO, Harrington is the chief scientist, Doudna is the chairman of the Scientific Advisory Board, and Chen is the technical director.

“She’s a multifaceted person and clearly a genius,” said Mayfield’s Parikh, a board member and serial investor in her company.

Venture investments in gene editing reach billions

CRISPR startups have raised $3 billion in venture capital since 2014, according to Chris Docomajilar, founder and CEO of biopharmaceutical database company DealForma. An analysis by the GlobalData Center for Pharmaceutical Intelligence shows that since 2012, there have been 74 venture capital deals for CRISPR technology companies, with Mammoth Biosciences leading among the most well-funded. The startup has raised $265 million in four investments from at least 15 venture capital firms and business angels.

The company’s operations expanded rapidly during the pandemic in 2020. Among the seven firms that received $249 million from the National Institutes of Health for rapid tests for Covid-19, the firm has scaled up its patented DetectR test for commercial virus-diagnosing labs. In collaboration with GSK Consumer Healthcare in Warren, New Jersey, a portable device is being created that can perform rapid coronavirus tests. Additionally, in early 2021, Mammoth Biosciences teamed up with Santa Clara-based Agilent Technologies to develop CRISPR testing systems for laboratories to expand and accelerate coronavirus disease detection.

“She has rare skills to conceptualize the future and what this technology can do for humanity,” said her other investor, Harsh Patel, co-founder and managing director of Wireframe Ventures. “It can turn incredible science in the lab into commercial technology products. This is a big step forward from the laboratory.”

More developments followed later in 2021 and this year. Boston-based Vertex Pharmaceuticals paid the startup $41 million to expand cell and genetic therapy tools, which could lead to $650 million in royalties. Bayer AG in Berlin has paid $40 million to Mammoth Biosciences to focus on testing and treating liver disease, with fees that could be up to $1 billion. What’s more, in January of this year, the FDA granted the company an Emergency Use Authorization for CRISPR-based molecular diagnostic testing of the coronavirus.

The achievement has been a test of Chen’s strength as an innovator and business leader, but investors say she is unflappable. “I never saw her exhausted at a board meeting. She has a strong opinion, and she backs it up not with arguments, but with data,” said Omri Amirav-Drori, general partner at venture capital firm NFX, investor and consultant. “I will never sell my shares, I will give them to my children. The company has a huge amount of intellectual property.”

Enlarge iconArrows pointing outward

To learn more and register for the CNBC Small Business Playbook, click here here.