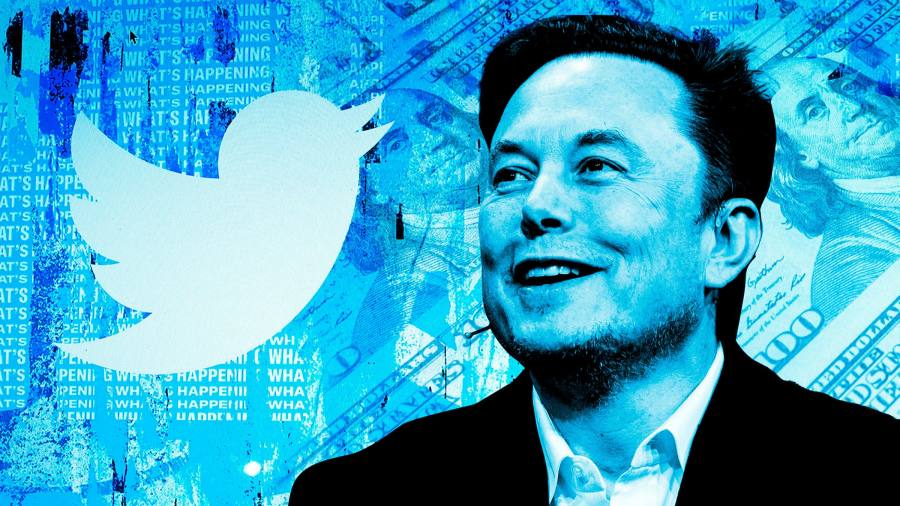

If Twitter’s executive initially thought Elon Musk’s offer to buy the social media company for $43 billion was just a stunt, it now finds itself on the defensive on several fronts.

After the world’s richest man revealed on Thursday how he intends to fund his takeover bid, Twitter executives are under pressure to come to the negotiating table with him or find alternatives, such as a “white knight” bidder who will offer them comes to the rescue as business nears a make-or-break moment.

For some, Musk’s offer has fueled hope that Twitter will be privatized to fix a perceived failure to innovate and find new revenue streams, though many don’t see Musk as the man for the job. It has also shone a spotlight on Twitter’s checkered history of sluggish innovation, technical failings, and leadership power struggles.

“Twitter was developed to a fraction of its full potential,” said a former board member. “God, yes, it was supposed to be private. There is a world where I can imagine the business being 10 to 100 times bigger.”

The board is “not enough in-between value in Musk’s offering, but maybe not enough ability to realize the greater value itself,” said a tech investor who doesn’t have a position at Twitter.

Twitter has grown much slower than other social media companies like Facebook and LinkedIn and has been less profitable. In 2020, it drew scrutiny from an activist investor, Elliott Management, over concerns that its founder and then-Chairman, Jack Dorsey, was being too outspoken and indecisive.

Analysts and advertisers have criticized Dorsey for being a Twitter purist, focusing too much on small changes to the core product while failing to aggressively look for ways to expand its advertising offering and drive revenue beyond ads to areas how to diversify subscriptions.

“Here is a company that has so much potential and keeps giving it away. They wrote almost an entire PhD thesis on missed opportunities,” said an advertising agency executive, adding that Twitter has failed to capitalize on areas such as short videos, ratings and reviews, and news.

Tech-focused buyout firm Thoma Bravo also believes the platform has been undermanaged and has untapped growth potential, according to a source familiar with its thinking.

The firm, which has over $100 billion in assets, has begun talking to Musk about participating in his takeover efforts, the source said, which several prominent lenders said could help the bid gain traction by attracting additional debt and equity funding from institutional investors. Thoma Bravo declined to comment.

Musk’s approach comes at a time of particular vulnerability for Twitter, which has just brought in a new CEO, Parag Agrawal, a longtime engineer at the company who is well respected internally but relatively unknown on Wall Street.

In a sign of tensions behind closed doors, Dorsey, who will remain on Twitter’s board until next month, said on Twitter this week that the board has been “the dysfunction of the company throughout,” without giving further details.

Twitter’s board of directors, which has been criticized for barely using the product or owning a lot of shares in the company, is led by Salesforce chief executive Bret Taylor. That includes Silver Lake’s Egon Durban, who came on after the company made a $1 billion investment two years ago — and whom Musk previously hired over his failed bid to privatize Tesla.

Dorsey “could be the vulnerability that triggers a potential shakedown or radical change on the board,” said Stefano Bonini, corporate governance expert at Stevens Institute of Technology.

Recommended

According to Ann Lipton, associate professor of business law and entrepreneurship at Tulane University, shareholders could pressure the board to accept a deal. But “it’s not apparent that shareholders are anxious to pressure the board to make this happen.”

If the social media company’s directors are serious about keeping Musk in check, the other credible plan B is to find a “white knight” who could offer an alternative to the $54.20 per share that the the entrepreneur who has already announced this has proposed his “best and last offer”.

Twitter has no shortage of potential buyers, but many are steering away from the company for now. In the past, big tech companies like Salesforce and Google have expressed interest in acquisitions. According to people close to executives at both companies, neither of them is currently interested in approaching Twitter.

Other big tech companies like Amazon, Facebook, Microsoft, and Apple may be interested in buying Twitter as they could all integrate the social media company into their existing businesses. However, the likelihood of either of them approving a deal is close to zero given Big Tech’s heightened antitrust scrutiny in Washington.

Recommended

Interest from private equity buyers in participating in a Musk-led acquisition remains lukewarm as a number of established potential buyers, including Blackstone, Brookfield and Vista, have chosen to stay away.

Twitter’s board of directors has yet to give Musk a formal response to his offer, but they have introduced a poison pill to slow his progress. But now that Musk has his funding in hand, the board needs to figure out what it wants to do, and fast.

Overcoming Musk’s advances “will take a very determined board,” Bonini said. “There is a possibility of a board shakedown, with some members leaving, some members changing their minds and some turbulence occurring.”

Additional reporting by Tim Bradshaw in London and Richard Waters in San Francisco