World Bank President David Malpass says the US and Europe have imposed “strong sanctions” that will affect global oil and food trade.

The S&P Goldman Sachs Commodity Index jumped 19.9%, its best weekly gain ever, according to the Dow Jones Market Data Group, as Russia invaded Ukraine, heightening uncertainty about the future of oil, wheat and corn., and other goods.

RUSSIA INVADES UKRAINE: LIVE UPDATES

S&P Goldman Sachs Commodity Index (Google Finance)

“The US has imposed strict sanctions, Europe has imposed strict sanctions, and this affects global oil trade as well as food. The food trade, which is so important that Russia and Ukraine have been major food suppliers,” said David Malpass, President of the World Bank, during an interview with Neil Cavuto of FOX Business.

“And now, when banks stop working with Russia, it changes trade routes. China can make up for some of this in the afternoon by buying some of the oil, some of the wheat from Russia. around the world, this is a huge supply shock,” he warned.

This, in turn, sent investors to safety in gold and out of US equities.

The S&P 500 and Dow Jones Industrials ended their fourth week of declines, while the Nasdaq Composite closed down three of the last four.

| Ticker | Security | past | Change | Change % |

|---|---|---|---|---|

| Me: DJI | DOW JONES AVERAGES | 33614.8 | -179.86 | -0.53% |

| SP500 | S&P 500 | 4328.87 | -34.62 | -0.79% |

| Me: COMP | COMPOSITE INDEX NASDAQ | 13313.438007 | -224.50 | -1.66% |

THE RUSSIAN ECONOMY DOES: WHAT IS DONE

We take a look at the sharp moves that rocked the commodities market this week.

US oil and Brent

US oil rose $24.09 a barrel, or 26.30%, to $115.68. The biggest–all-time weekly increase since April 1983, when price tracking began. It is now at its highest level since September 2008. World benchmark Brent rose $23.99 a barrel, or 25.49%, to $118.11 this week, also the highest since January 1991.

| Ticker | Security | past | Change | Change % |

|---|---|---|---|---|

| USO | UNITED STATES PETROLEUM FUND LP | 79.43 | +4.86 | +6.52% |

| BNO | UNITED STS BRENT OIL FD | 32.77 | +2.08 | +6.78% |

Gold

| Ticker | Security | past | Change | Change % |

|---|---|---|---|---|

| GLD | SPDR GOLD SHARES TRUST – EUR ACC | 183.68 | +2.87 | +1.59% |

| NEM | NEWMONT CORP. | 74.32 | +3.63 | +5.14% |

| GOLD | BARRICK GOLD CORP. | 24.21 | +0.63 | +2.67% |

The yellow metal is up $78.60 a troy ounce, or 4.17%, to $1965.10 this week and is at its highest level since September 2020. While gold is a safe haven in times of uncertainty, it is also a hedge against inflation, which remains at record levels. at consumer and producer prices.

INFLATIONAL COUNTRY: THESE STATES PAY THE HIGHEST PRICES

Last Sunday, Russia’s Central Bank said it was “resuming” gold purchases. Shaokai Fang of the World Gold Council told FOX Business that Russia has been actively buying gold since the financial crisis in 2008, but has reduced sales in 2018.

gas prices

| Ticker | Security | past | Change | Change % |

|---|---|---|---|---|

| UGA | UNITED STATES PETROL FUND LP PARTNER UNITS | 61.97 | +4.07 | +7.03% |

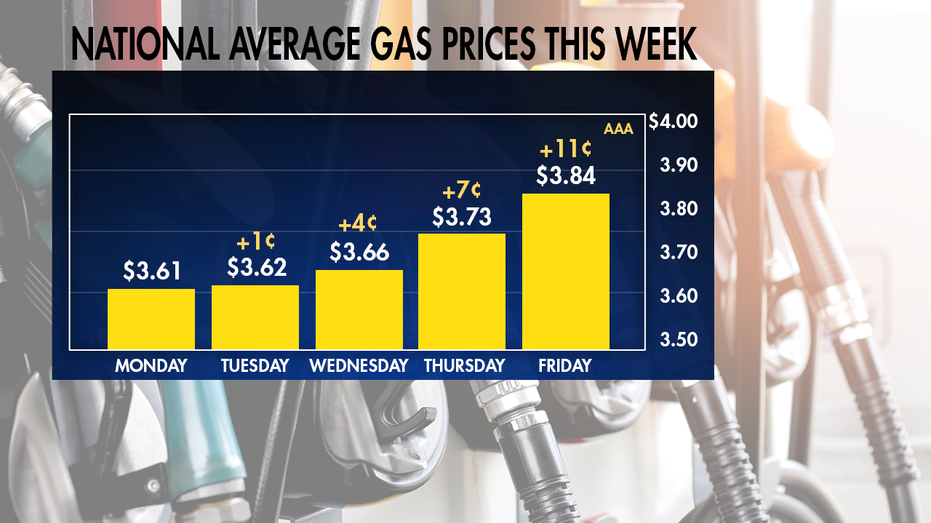

National average gas station prices reached $3.87, rising 11 cents Thursday through Friday, the biggest single-day increase since records began in 2000, according to the AAA. Gas is now $1.08 higher than a year ago. Prices are approaching $4 a gallon, a level not seen since July 2008.

CLICK HERE TO READ MORE ABOUT FOX BUSINESS

Soft commodities – corn, wheat, soybeans

Wheat futures traded above $11.45+, the highest since 2008, according to Trading Economics data. Ukraine and Russia together account for about 30% of world wheat exports. A conflict between the two countries could jeopardize long-term supplies. Corn traded above $7.50, the highest since May 2021, while soybeans hit a September 2012 high of $17.

WHEAT AND CORN PRICES UP IN RUSSIA AND CONFLICT IN UKRAINE

| Ticker | Security | past | Change | Change % |

|---|---|---|---|---|

| PSEI | TEUCRIUM COMMODITY TRUST WHEAT FUND | 10.83 | -0.28 | -2.52% |

| CORN | TEUCRIUM COMMODITY TRUST CORN USD | 26.19 | +0.69 | +2.71% |

| SOIB | TEUCRIUM COMMODITY TRUST SOYABEAN USD | 27.06 | -0.18 | -0.66% |

Mark Smith of FOX Business Network contributed to this report.

CLICK HERE CLICK FOX BUSINESS ON THE ROAD