A worker ties copper wires together before loading them onto a truck in Huai'an, Jiangsu Province, China.

Vcg | Visual China Group | Getty Images

Copper prices are expected to rise more than 75% over the next two years due to mining supply constraints and higher demand for the metal, fueled by renewable energy support.

Rising demand due to the green energy transition and a likely decline in the US dollar in the second half of 2024 will drive copper prices higher, according to a report from BMI, a research unit of Fitch Solutions.

Markets expect the Federal Reserve to cut interest rates this year, which will weaken the dollar and in turn make dollar-priced copper more attractive to foreign buyers.

“The positive view for copper is based more on macroeconomic factors,” Matty Zhao, head of Asia-Pacific commodities at Bank of America Securities, told CNBC, citing likely Fed rate cuts and a weaker U.S. dollar.

Additionally, at the recent COP28 climate conference, more than 60 countries backed a plan to triple global renewable energy capacity by 2030, a move that Citibank said “would be extremely bullish for copper.”

In a December report, the investment bank predicted that higher renewable energy targets would increase copper demand by an additional 4.2 million tonnes by 2030.

The report added that this would potentially push copper prices to $15,000 a tonne in 2025, well above the record high of $10,730 a tonne in March last year.

“This assumes a very soft landing in the US and Europe, an earlier global growth recovery and significant easing in China,” Citi analysts said, while highlighting continued investment in the energy transition sector.

A growing economy tends to increase demand for copper, which is used in electrical appliances and industrial machinery. Demand for the metal is seen as an indicator of economic health.

Copper came last on the London Metal Exchange The price is $8,559 per ton.

The base metal is a linchpin in the energy transition ecosystem and is essential for the production of electric vehicles, power grids and wind turbines.

See grafic…

Copper prices last year

Other analysts see an uptick in copper due to mining disruptions, with Goldman Sachs expecting a deficit of over half a million tonnes in 2024.

Last November, First Quantum Minerals halted production at Cobre Panamá, one of the world's largest copper mines, following a Supreme Court ruling and nationwide protests over environmental concerns. Anglo American, a major producer, said it would cut copper production in 2024 and 2025 to reduce costs.

“The supply cuts reinforce our view that the copper market is entering a period of significantly more severe shortages,” wrote Goldman analysts, who expect copper prices to reach $10,000 a ton within the year and much higher in 2025 become.

According to BMI estimates, the winners of the copper rush will primarily be Chile and Peru. Both countries have large reserves of green transition minerals such as lithium and copper, which will benefit from increased investment and higher export demand. Chile has around 21% of the world's copper reserves.

“We are confident that the copper price will improve significantly by 2025.” [of $15,000 per ton average] is significantly higher now,” Goldman said.

Lower supply also means new copper smelters coming online will have a shortage of concentrates to work with, said Wang Ruilin, senior copper analyst at S&P Global.

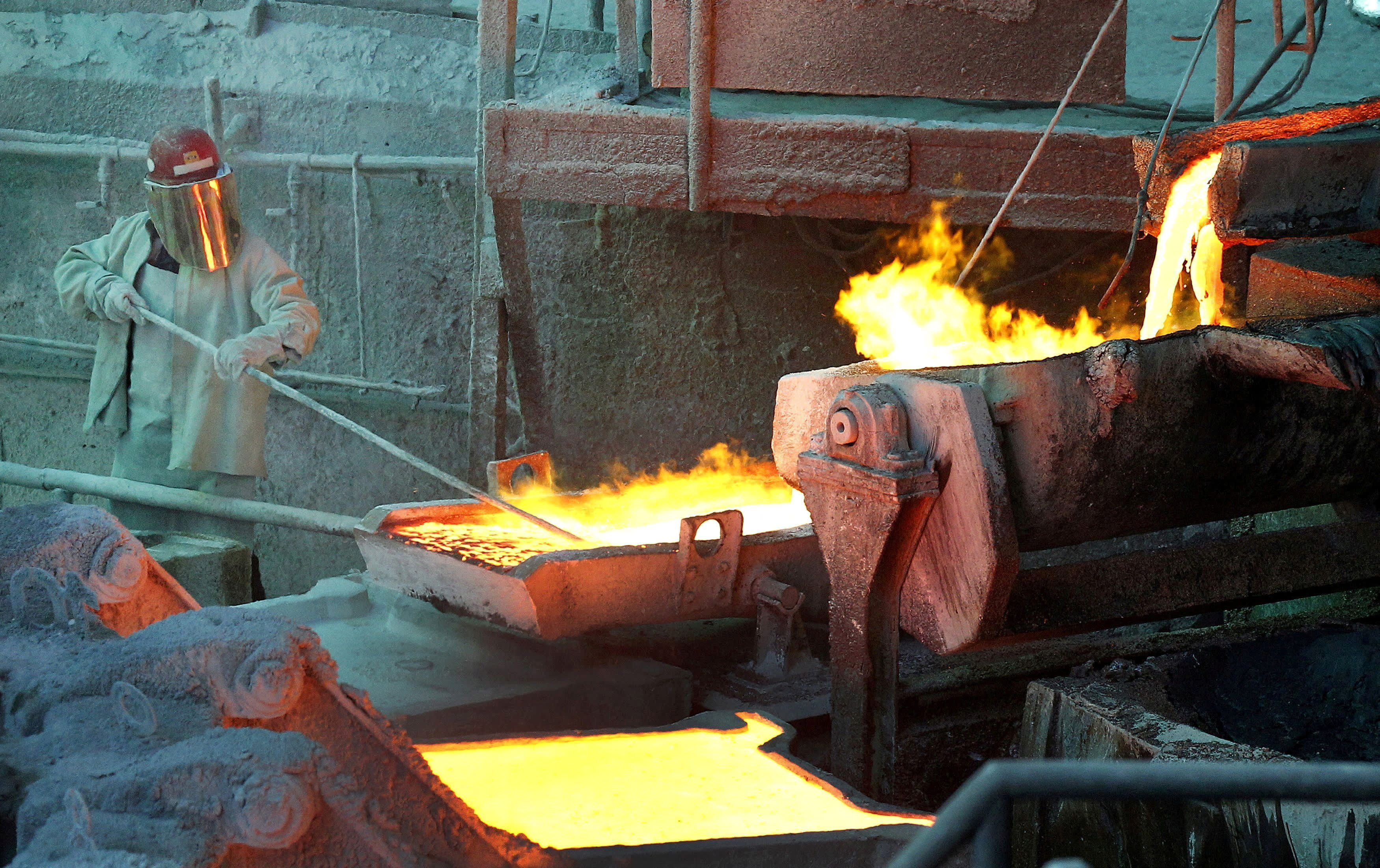

Copper ores are extracted from the earth and then converted into copper concentrates. From there they are sent to smelting furnaces where they are purified into refined copper, which is the benchmark for the LME price.

A worker monitors a process at the Codelco Ventanas copper smelter in Ventanas, Chile, January 7, 2015.

Rodrigo Garrido | Portal

“Copper smelters will face a concentrate supply shortage beginning in 2024, and projected concentrate market shortfalls are expected to worsen in 2025-27,” she told CNBC via email.