California Gov. Gavin Newsom said the state’s budget deficit is expected to widen to nearly $32 billion, nearly $10 billion more than he forecast in January.

Newsom on Friday unveiled its revised budget for the fiscal year beginning July 1, proposing a plan aimed at covering the deficit while the state may face multibillion-dollar deficits in the future.

“It hasn’t been an easy household, but I hope you’ll see that we’ll do our best to stay on top of things and look after those who are most vulnerable and in need, while still maintaining prudence,” Newsom said.

To meet the projected deficit, Newsom proposed a combination of modest spending cuts, increased borrowing and a plan to defer some spending to future fiscal years, resulting in a projected annual deficit of $14 billion by 2027.

Republicans in the state legislature have criticized Newsom’s plan. GOP Group leader James Gallagher said in a statement: “His cuts to drought programs are dangerous, his ‘fiscal shenanigans’ are short-sighted and his words about good government and efficiency are yet another empty promise.” Californians deserve better”

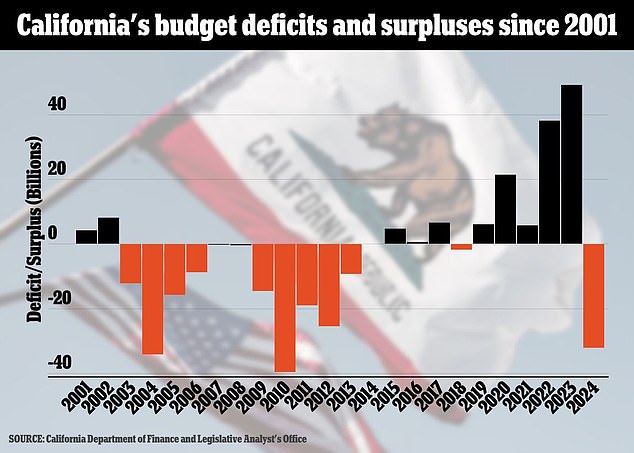

The projected $31.5 billion shortfall would be California’s first budget deficit since Newsom took office in 2019 and follows several years of booming surpluses and rising tax revenues

The projected $31.5 billion shortfall would be California’s first budget deficit since Newsom took office in 2019 and follows several years of booming surpluses and rising tax revenues.

California has a progressive tax system that relies heavily on the wealthy and taxes investment gains as regular income, meaning the country gets about half of its earnings from just 1 percent of the population.

When the economy is doing well and the stock market is booming, the rich pay more in taxes and earnings can skyrocket. When the economy is doing badly, they pay less and earnings can fall just as quickly.

Newsom, a second-term Democrat, did not propose major tax increases for individuals or spending cuts on the state’s key programs, including those affecting public education, health care and homelessness.

His plan would cut spending by about $10.6 billion — about $1 billion more than he proposed in January — while covering the remainder of the deficit through a combination of borrowing and deferring some spending while others spend be shifted to other sources.

Unlike the federal government, California is required to adopt a balanced budget each year—that is, the state’s income and expenditure must be equal. Newsom’s budget is balanced this year.

But in the future it would oblige the state to spend more money than it is likely to have at its disposal. Under Newsom’s plan, the deficit would be $5 billion next year and grow to $14 billion by 2027.

“The fact that the governor continues to overspend and create structural deficits for years to come is fiscally irresponsible,” said Rep. Vince Fong, a Bakersfield Republican and vice chair of the convention’s budget committee.

California Gov. Gavin Newsom said the state’s budget deficit is expected to widen to nearly $32 billion, nearly $10 billion more than he forecast in January

Newsom’s budget includes $3.7 billion for various programs aimed at moving the homeless off the streets into shelters. Pictured: San Francisco homeless camp in January

Newsom said it’s common for future budgets to be imbalanced, especially in lean years.

He also said the Democrats, who control the state government, have learned to use the volatile tax system to their advantage. Newsom’s plan would leave California with $37.2 billion in various savings accounts, money he says could be used to balance future budgets.

“A progressive tax system allows us to accumulate billions and billions of dollars for this very moment,” Newsom said.

It’s especially difficult to predict how much money California will have this year after a series of severe and devastating storms prompted state officials to extend the normal April tax return deadline through October for nearly all residents.

Newsom said he hopes the state will take in about $42 billion in October, but he doesn’t know exactly.

“I want all $42 billion and up,” Newsom said. “I want to be surprised.”

While the governor’s proposed spending cuts are small, they are likely to impact several core programs.

Newsom’s budget earmarks $3.7 billion for various programs aimed at getting the homeless off the streets into shelters, but he wants to cut some spending on related housing issues, even in the face of severe shortages.

The governor has proposed about $700 million in cuts or spending deferrals, delaying funds for programs that help nonprofits convert foreclosed properties into affordable housing and reclaiming funds used to convert commercial and industrial buildings into housing were determined.

“It’s disappointing that the governor isn’t taking major action to address California’s deepening housing crisis,” said Michelle Pariset, director of legislative affairs at Public Advocates, a nonprofit law firm and advocacy group.

“Unless we address the housing issues in our communities at the scale of the problem, we will see more and more of our neighbors struggling, displaced and pushed into homelessness.”

Newsom’s budget proposal must first be approved by the Democratic-controlled Legislature.

A series of severe storms prompted California to push back the tax return deadline for nearly all residents to October, complicating budget forecasting. Pictured: A military vehicle drives through flood waters March 14 in Pajaro, California

An aerial view shows homes submerged after a levee breached March 21 in San Joaquin County, California. California has been hit by a series of devastating floods and storms this year

Since taking office in 2019, Newsom’s biggest budget dispute with lawmakers has been over how to spend record-breaking surpluses, and agreeing on cuts could be more difficult.

Newsom last year approved an expansion of a subsidized childcare program to help an additional 20,000 families. However, he is now proposing to postpone the funding by a year because the state is having difficulties filling the childcare places that are available.

That angered some Democrat lawmakers, who said the problem was that there weren’t enough childcare workers.

On Monday, Democrats in Parliament proposed $1 billion in new spending to increase wages for those workers, and on Friday Speaker Anthony Rendon said improving childcare would be a priority.

“Improving child care rates benefits children and the economy,” Rendon said.

Newsom’s budget would also protect spending in other priority areas, such as extending eligibility to Medicaid, the federally funded health insurance program for the poor and disabled.

“We appreciate the continued commitment to improving and expanding (Medicaid), a lifeline for 15 million Californians, over a third of the state,” said Anthony Wright, executive director of the advocacy group Health Access California.

The budget would loan $150 million to some public hospitals threatened with closure.

And it would reinstate a 2022-expired tax on managed care organizations, private companies that contract with the state to administer Medicaid benefits, giving the state an estimated $19.5 billion in additional benefits through 2026 would generate income.

Newsom said he wants to use some of that money to increase Medicaid spending on care, which would benefit hospitals and other providers.