(Bloomberg) – A growing list of risks is turning China into a potential swamp for global investors.

Most read by Bloomberg

The central question is what might happen in a country willing to go to great lengths to achieve its leader’s goals. President Xi Jinping’s friendship with Russian leader Vladimir Putin has caused investors to become more wary of China, while a strongman narrative is gaining momentum as the Communist Party doggedly pursues a Covid-zero strategy and unpredictable campaigns to regulate entire industries pursued.

As a result, some international investors are increasingly uncomfortable with an aggressive allocation to China. Outflows from the country’s stocks, bonds and mutual funds accelerated following Russia’s invasion of Ukraine, while Norway’s $1.3 trillion sovereign wealth fund has snubbed a Chinese sportswear giant over concerns about human rights abuses. U.S. dollar private equity funds investing in China raised just $1.4 billion in the first quarter — the lowest number since 2018 for the same period. On Monday, China’s better-than-expected economic data prompted questions from analysts who pointed to inconsistencies with alternative statistics that paint a bleak picture of the economy.

According to Simon Edelsten of British investment firm Artemis Investment Management LLP, the scale and speed of the sanctions imposed on Russia have forced a rethinking of Western attitudes towards China. His team at the $37 billion money manager sold all of its China investments last year after Beijing intervened in high-profile listings like Didi Global Inc. and Ant Group Co., saying such moves threaten shareholder rights. China’s more assertive rhetoric regarding Hong Kong and claims of sovereignty in the South China Sea also worried the investment team, Edelsten said.

The story goes on

“Politics and governance factors should now set a cautious tone, especially on long-term commitments,” Edelsten said, adding that European action against Russia shows strong trade ties are no guarantee of diplomatic security.

“The invasion of Ukraine greatly increases these risks and our funds are likely to remain very low weight in China for a few more years,” he added.

Brendan Ahern, chief investment officer at Krane Funds Advisors LLC, describes the “indiscriminate and price-insensitive sale” of Chinese stocks by international investors over the past year.

Beijing’s regulatory moves “felt like an attack on the most prestigious and largely foreign-owned companies,” he said, while sanctions on Russia raised concerns the same could happen to China. His firm – which manages China-focused exchange-traded funds – is replacing US-listed Chinese stocks with those traded in Hong Kong to reduce risk.

It has become more difficult to make money in China’s public markets. The CSI 300 stock index is down about 15% year-to-date and its risk-adjusted return – as measured by the Sharpe ratio – is among the lowest in the world at -2.1. This is only marginally better than the Sri Lankan Colombo All-Share Index. The China index is trading near the lowest level since 2014 compared to the MSCI Inc. global equity measure.

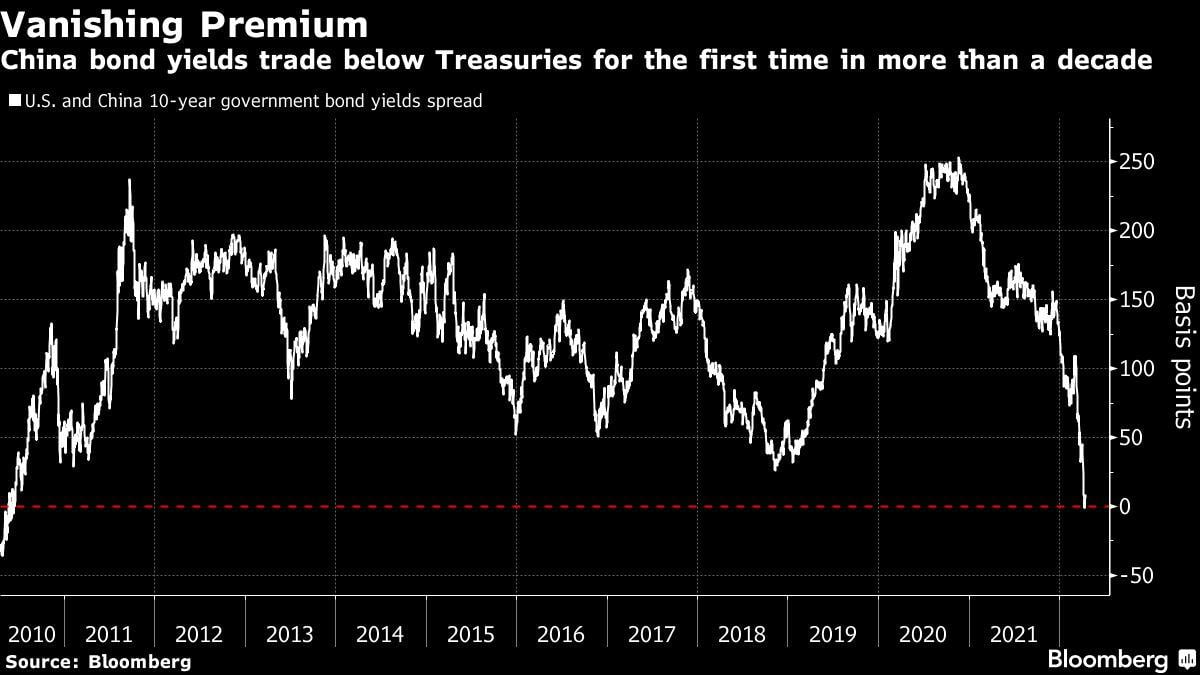

For the first time since 2010, benchmark 10-year Chinese government bonds offer no rollover to comparable US Treasuries. And returns in China’s high-yield dollar credit market last quarter were their worst in at least a decade.

Read more: China jitter rises as calls for easing reverberate across trading floors

Global funds have begun to pull out, selling more than $7 billion worth of mainland-listed shares through exchange links with Hong Kong in March. They have also dumped $14 billion in Chinese government debt and reduced their loan portfolios in the past two months. Bets against China have been highlighted in Bank of America Corp.’s latest investor survey. considered the 5th most common trade.

“Markets are worried about China’s ties to Russia – it scares investors and you can see that risk aversion since the invasion began,” said Stephen Innes, managing partner at SPI Asset Management. “Everyone was selling Chinese bonds, so we’re glad we didn’t buy any.”

Still, exiting China may not be an easy decision. The world’s second largest economy has a $21 trillion bond market and $16.4 trillion in stock exchanges on land and in Hong Kong. Its assets offer investors diversification, Joevin Teo, head of investment at Amundi Singapore Ltd., said last week as multi-asset strategies struggle amid inflationary threats and tightening global financial conditions. Some have even called Chinese assets a haven.

“It’s one of the best diversification stories for global funds because of its idiosyncratic nature,” said Lin Jing Leong, senior government analyst for emerging markets in Asia at Columbia Threadneedle Investments, which has about $754 billion under management. “Who owns the market, the cycle of China’s growth and inflationary pressures, the low volatility of its basket of currencies” all contribute to better risk-adjusted returns, she added.

Chinese authorities appear to be taking steps to appeal for global funds. Regulators vowed last month to ensure policies become more transparent and predictable — major sticking points for investors who lost trillions of dollars in 2021 to Beijing’s crackdown on tech and tutoring firms. China is also making compromises that could give US regulators partial access to audits of US-listed Chinese companies.

As Wall Street giants like JPMorgan Chase & Co. and Goldman Sachs Group Inc. rush to take full responsibility for their China ventures, some companies are breaking up.

In March, Germany’s Fraport AG sold its stake in Xi’an Airport to a local buyer, ending a 14-year operation in China. The airport operator said it decided to exit the Chinese market after struggling to expand its business. Fraport also owns a stake in St. Petersburg Airport in Russia, which it cannot currently sell.

Others are preparing for China’s decoupling from the West. Self-driving technology start-up TuSimple Inc. is considering spinning off its operations in China into a separate entity after American authorities raised concerns about Beijing’s access to its data. Oil giant Cnooc Ltd. could halt its operations in the UK, Canada and the US amid concerns the assets could be subject to sanctions, Reuters reported last week.

Investment professionals at an American private equity fund in Hong Kong are not pursuing opportunities in China as aggressively as before, despite prices being far lower, according to a person who asked not to be named to discuss internal strategies . Concerns include the difficulty of exiting investments and problems that may arise from hardening positions such as US investment bans or a consumer boycott of Chinese-made products.

As risks rise and rewards fall, exposure to China may no longer come naturally to global investors. In a speech last week, US Treasury Secretary Janet Yellen called on Beijing to account for its ever-closer ties with Moscow.

“The world’s attitude towards China and its willingness to embrace further economic integration may well be influenced by China’s response to our call for decisive action on Russia,” she said.

(Adds GDP data in 20th paragraph)

Most Read by Bloomberg Businessweek

©2022 Bloomberg LP