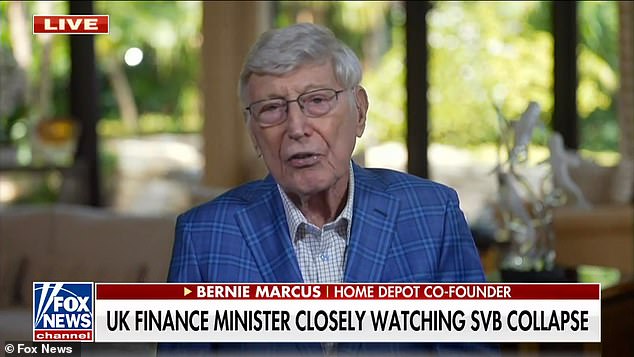

Home Depot co-founder Bernie Marcus says Americans need to “wake up” to the reality that the US economy is facing tough times following the collapse of the Silicon Valley bank.

Marcus also blamed part of the bank’s failure on the Biden administration for prioritizing “global warming” over shareholder returns.

Marcus argued that the bank’s collapse showed the US economy was not as strong as President Biden had suggested.

He criticized bank officials for selling their stock before the collapse and bemoaned the fact that many Americans were losing their money in what he called an “awakened bank.”

“I can’t wait for Biden to get back on the floor and talk about how great the economy is and how it’s moving forward and getting stronger by the day. And that is an indication that what he says is not true.

“And perhaps the American people will finally wake up and understand that we are living in very difficult times, that indeed a recession may have already begun. Who knows? But it’s not looking good,” Marcus said on Fox News on Saturday.

Home Depot co-founder Bernie Marcus is urging Americans to pay attention and understand the country is going through “tough times” following the collapse of SV Bank

People queue in front of the closed Silicon Valley Bank (SVB) headquarters on March 10, 2023 in Santa Clara, California

Marcus accused the Biden administration of pushing banks to prioritize “diversity and all the issues raised” over shareholder returns and suggested that a focus on social policies now leads to banks being mismanaged and not protecting their shareholders and their own employees.

“I feel sorry for all these people who lost all their money in this woke bank. You know, it was more depressing to hear that the bank teller sold their stock before this happened. It’s depressing for me. Who knows if the Justice Department would go after them? They’re a bright company, so I don’t think so. And they’ll probably get away with it,” he continued.

Marcus then warned that the US economy is in trouble as the Federal Reserve hikes interest rates and inflation is headed in the wrong direction.

“I think that’s the system that the administration has pushed a lot of these banks into [being] more concerned about global warming than shareholder returns. And these banks are mismanaged because everyone is focused on diversity and all the woke issues and not focused on what they should, which is shareholder returns,” Marcus told Fox.

Marcus said he doesn’t believe President Biden’s speeches when he talks about improving the economy

“Instead of protecting shareholders and their employees, they care more about social policies. And I think it’s probably a badly run bank. They have been there for many years. It’s pathetic that so many people have lost money that aren’t getting it back.”

Marcus has criticized Biden’s proposal to tax the middle class and the wealthy, calling it “stupid” and arguing that such policies are counterproductive in a downturn.

But Marcus’ warning is dire and he believes the US economy is in serious trouble with the collapse of the Silicon Valley bank, a sign for the future as he believes the US needs to take a more sensible approach to economic policy if they want to weather the storm.

He argued that people are struggling to pay their bills and fill their tanks with gas, which he says the Biden administration is “stupid” about such issues.

Marcus demanded that someone with a “sound mind” come in and understand that the US can’t keep raising interest rates, can keep inflation as high as it is, and is taxing people more than they are already being taxed.

“The Fed continues to hike rates and inflation continues to move in the wrong direction. It doesn’t stay where it should be. The people fight. They can’t fill their tanks with gasoline. And if you think that’s a good sign, I don’t think it is. And we have a government that is obtuse about it. They just keep talking about the great times and how good it is. That’s not good,’ concluded Marcus.

“Someone with a sane mind has to come in and understand that you can’t do two things. Number one, you can’t keep raising interest rates. You can’t keep inflation as strong as it is. And you can’t tax people more than they are.[Biden’s] Proposal to tax the middle class and the rich is about as stupid as I’ve heard in a long time. You don’t do that in a recession like this.”

Mark Cuban, entrepreneurial owner of the Dallas Mavericks, has called on the Federal Reserve to act quickly and take responsibility for Silicon Valley Bank’s fallout

Meanwhile, Mark Cuban, entrepreneurial owner of the Dallas Mavericks, has called on the Federal Reserve to act quickly and take responsibility for Silicon Valley Bank’s fallout.

Cuban released a series of tweets urging the Fed to buy all of SVB’s securities and debt at a price close to par, which should cover most deposits.

He suggested paying for any losses with equity and new debt from the new bank or its potential buyers.

“The Fed should IMMEDIATELY purchase all securities/debt owned by the bank at near face value, which should be enough to cover most deposits,” Cuban wrote online.

“All losses paid with equity and new debt from the new bank or whoever is buying it. The Fed knew this was a risk. You should own it

“If the Fed doesn’t own it, confidence in the banking system becomes an issue. There are a lot of banks with more than 50 percent uninsured deposits.’

“If your business is writing millions of dollars in checks every week, what would be best practices to guard against a future onslaught?”

Cuban argued that the Fed knew such a risk existed and should assume it.

Otherwise, confidence in the banking system could be undermined, as many banks have uninsured deposits in excess of 50 percent.

Cuban also questioned the role of regulators in overseeing SVB and expressed surprise that the bank was allowed to operate as it did.

The bank had a reputation for being the go-to place for Silicon Valley startups, and ranks companies like Airbnb, DoorDash, and DropBox among its recommendations.