Natural gas prices rose for the third time in four days on Friday, fueled by worries about global supplies fueled by Russia’s invasion of Ukraine, higher European prices and the associated prospect of a prolonged period of record U.S. liquefied natural gas (LNG) demand.

At a glance:

- Russia continues its attack on Ukraine

- Markets have assessed the potential of new sanctions

- Northeast hubs cut cash prices

The April futures contract for gas on the New York Stock Exchange rose by 29.4 cents on the day and settled at $5.016/mmbtu. May rose 30.0 cents to $5,036.

However, the national average for NGI Spot Gas fell 64.5 cents to $4.495 on expectations of mild weather over the weekend and weak domestic demand in the short term.

At the end of the week, Russia shelled southern Ukraine, causing a fire at the largest nuclear power plant in Europe, according to the Associated Press. The fire was contained, but the attack heightened already heightened concerns about Russia’s indiscriminate shelling of its Eastern European neighbor.

As the war dragged into its second week, markets have weighed in on the possibility of direct Western sanctions on Russian oil and gas that could deplete supplies to Europe in the winter, when the continent no longer has enough natural gas in storage. Stock cuts in Europe will increase calls for US LNG exports and, in turn, could lead to further increases in global prices.

U.S. LNG feed gas volumes topped 13 billion cubic feet on Friday and hovered near record levels.

The value of a gas contract to transfer ownership — a European benchmark — has hovered well above $50 for much of the past week, “reflecting extreme market uncertainty as the push into Ukraine escalates,” Rystad Energy’s Kaushal Ramesh said.

Transit volumes of Russian gas bound for Europe remained stable on Friday, but “traders are nervous about how long this can go on without a hitch,” said senior analyst Ramesh. He noted that the United States already “requires that dollar payments for Russian energy exports be routed through banks in third countries, which complicates energy transactions.”

In the absence of significant daily changes in weather or domestic production, production was flat at around 95 bcm on Friday.

“Expecting the market to pull out of data right now is a futile exercise, and it could stay that way for some time,” Bispock said. “This movement based on the situation in Europe is very likely to continue for a while, regardless of anything shown in the data, so now is the time to just stay neutral and watch the dust settle.”

Friday’s forecasts showed “steady mid-month cooling compared to the season, but hints of warming later in the month,” Bespok said.

Meanwhile, markets continued to digest the latest US Energy Information Administration (EIA) inventories data released on Thursday. The EIA reported a withdrawal of 139 billion cubic feet of natural gas from storage for the week ended Feb. 25, broadly in line with expectations.

The bottom 48 storage facilities ended the week at 1,643 billion cubic meters. feet, which is 255 billion cubic meters. feet below the five-year average, according to the EIA.

Adjusted for the weather, analysts at Tudor, Pickering, Holt & Co. (TPH) estimated a market supply shortfall of 0.4 billion cubic feet per day during the latest week of the EIA report.

“On the demand side, recent forecasts called for cooler-than-usual temperatures in March,” while power generation, along with residential/commercial and industrial demand, “was largely in line with historical levels in recent days,” TPH analysts said. .

Industrial and commercial demand could pick up along with the US economy, which added 678,000 jobs in February. The Labor Department said on Friday that the unemployment rate fell to 3.8% from 4.0% the previous month. Revised estimates showed that 481,000 jobs were added in January and 588,000 in December, higher than previously estimated.

War, however, looms as a wildcard.

“Russia’s invasion of Ukraine and subsequent economic sanctions have increased risks to the global economic outlook,” Moody’s Investors Service said in a Friday report. “The scale of the impact will depend on the length and severity of the crisis.”

An escalation or protracted conflict “will jeopardize Europe’s economic recovery. The rest of the world will suffer from shocks in commodity prices at a time when inflation is already high,” Moody’s said.

Spraying Spot Prices

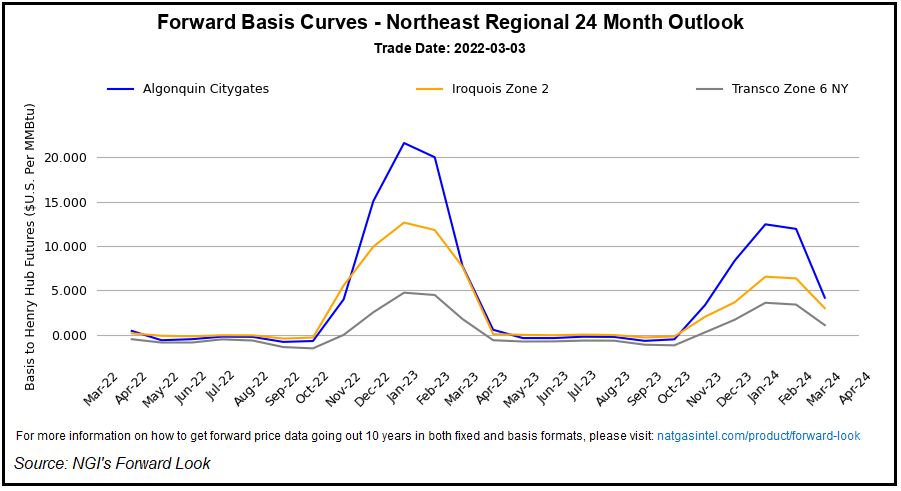

Prices declined the following day on Friday, continuing the trend of the trading week. Hubs in the northeast, where prices were inflated due to supply constraints and high winter demand in February, led to declines with ongoing losses.

Algonquin Citygate near Boston fell $10,640 on the day to $4,730 on average, while Transco Zone 6 NY lost 93.5 cents to $3,960.

However, in the Midwest and West, spot prices rose on the back of a cold snap and a “small jump” in demand on Friday, according to NatGasWeather.

On a national average, shares of Chicago Citygate rose 20 cents to $4,585 and Consumers Energy rose 11.5 cents to $4,565.

Malin added 25.5 cents to $4.435 and PG&E Citygate rose 23.0 cents to $5.640.

However, NatGasWeather expected “very low demand” over the weekend and Monday “as warmer temperatures rise”, including nearly all 48 lower layers.

The warming over the weekend is expected to mark the first of four distinct periods of national demand over the next two weeks, with demand near-normal by the end of next week, strong demand March 12-15 and then return to low national demand March 16-30 . 18, according to NatGasWeather.

While “it’s cold enough from March 8 to 14, the picture before and after is not the same,” the firm added. “Had the environment from March 16 to March 19 been colder, the picture to come would have been more frightening.”