New York Community Bank (NYCB) made a dramatic attempt to regain investor confidence by announcing a new CEO and a $1 billion cash infusion from a group that includes former Treasury Secretary Steven Mnuchin.

Wednesday's moves came after shares of the $114 billion lender fell as much as 45% following reports that NYCB was looking for investors willing to buy shares in the company.

After the $1 billion deal was announced, the stock rallied as much as 18%. It ended the day up more than 7%.

Firms lined up to provide the infusion included Liberty Strategic Capital, a company Mnuchin founded in 2021, as well as Hudson Bay Capital, Reverence Capital Partners and Citadel Global Equities.

She and several bank executives will buy common and convertible preferred stock, effectively taking control of the Hicksville, N.Y.-based company.

The deal also brings a new change at the top. Former Comptroller of the Currency Joseph Otting will become NYCB's new CEO, the third person to hold the title in recent weeks.

The transaction is scheduled to close on March 11 and is subject to regulatory approval.

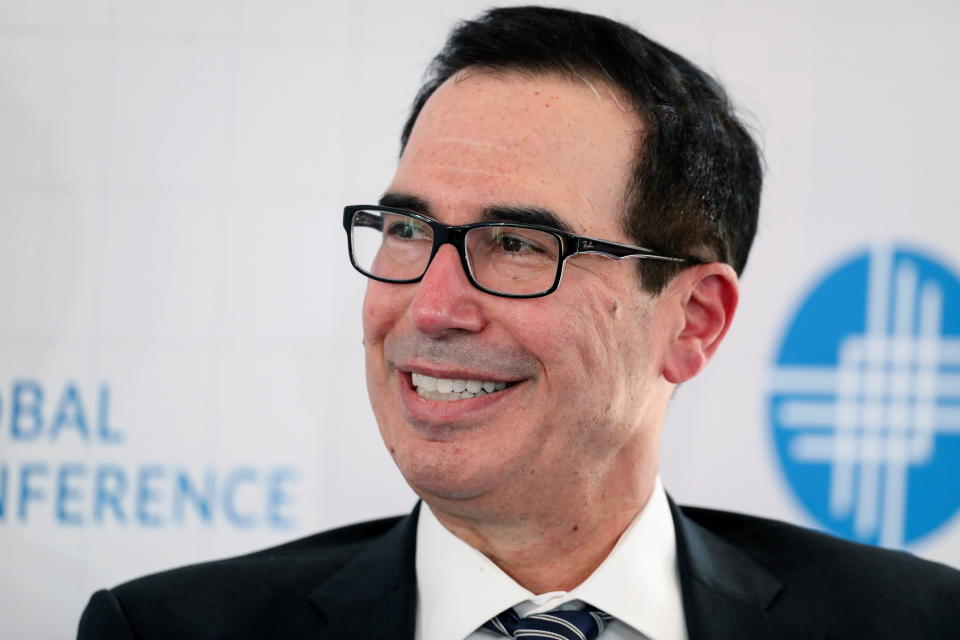

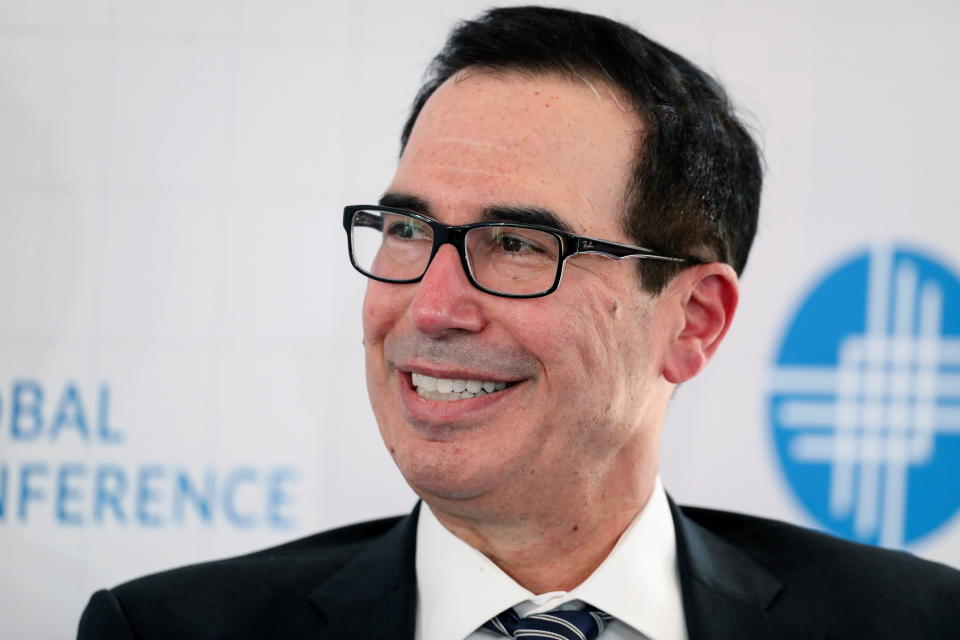

Steven Mnuchin, founder of Liberty Strategic Capital and former Treasury Secretary. Portal/David Swanson (Portal / Portal)

“In evaluating this investment, we considered the bank’s credit risk profile,” Mnuchin said in a news release. His company is expected to contribute $450 million, more than the other investors.

“With over $1 billion of capital invested in the bank, we believe we now have sufficient capital should reserves need to be increased in the future to match or exceed the coverage ratio of NYCB's major bank peers to surpass.”

Mnuchin, who served as Treasury secretary under President Donald Trump and was previously a partner at Goldman Sachs, has experience with another troubled bank.

IndyMac was a major bank failure during the 2008 financial crisis. (AP Photo/Nick Ut) (ASSOCIATED PRESS)

In 2009, he was part of a group of investors that acquired California mortgage lender IndyMac Bank for about $1.5 billion after it was seized by the federal government during the 2008 financial crisis.

The story goes on

He and the group renamed the lender OneWest and hired Otting to handle the turnaround. OneWest was eventually sold to CIT Bank for more than $3 billion, and Otting later served as acting Comptroller of the Currency during the Trump administration.

This renewed rescue of NYCB brings several changes in NYCB's leadership. Otting replaces as CEO Alessandro DiNello, who served as the bank's true boss since February 6 and officially became CEO last week following the departure of longtime CEO Thomas Cangemi.

DiNello will become non-executive chairman of a smaller nine-member board that includes a number of new faces, including Mnuchin, Otting, Hudson Bay's Allen Puwalski and Reverence Capital's Milton Berlinski.

“We welcome the approach that Liberty and its partners have taken in evaluating the bank and look forward to incorporating their insights in the future,” said DiNello. It is “a positive confirmation of the ongoing trend reversal and allows us to implement our strategy from a position of strength.”

NYCB shares first began falling on Jan. 31 when it surprised analysts by cutting its dividend and setting aside more for loan losses.

The turmoil intensified again last week after the company announced the exit of Cangemi, weaknesses in its internal controls and a tenfold increase in its fourth-quarter loss to $2.7 billion.

The dilemma facing New York Community Bancorp comes about a year after the collapses of Silicon Valley Bank and Signature Bank, whose seizures sparked widespread panic among depositors.

Now there are new fears that the growing weakness in commercial real estate could spill over into other banks and cause new problems.

Fed Chairman Jerome Powell said Wednesday that banks' exposure to commercial real estate was “manageable” but that “some lenders will experience losses.”

The Fed is in contact with banks to ensure they have enough liquidity and capital to absorb any losses, he told lawmakers during a hearing in Washington.

Federal Reserve Board Chairman Jerome Powell appeared before the House Financial Services Committee on Wednesday. (AP Photo/Mark Schiefelbein) (ASSOCIATED PRESS)

“I am confident that we are doing the right things. I believe the problem is manageable. If that changes, I will say so.”

NYCB played the role of savior during last year's crisis, agreeing to take over Signature's assets seized by regulators. But it also pushed NYCB's assets past $100 billion, a threshold that drew tighter scrutiny from regulators.

NYCB said these stricter requirements led to the decision to cut the dividend and set aside more for future loan losses.

A New York Community Bank branch in Brooklyn. (Photo by Spencer Platt/Getty Images) (Spencer Platt via Getty Images)

It allocated $552 million, well above estimates, to address weaknesses related to office properties and multifamily housing. NYCB is a major lender of rent-controlled apartments in New York City.

The panic at Silicon Valley Bank began last March after the bank sold assets at a loss, making it harder to raise needed capital.

“When you sell assets, you take losses, so it's better to have capital before you sell assets,” Chris Marinac, a Janney analyst who covers the bank, told Yahoo Finance.

David Hollerith is a senior reporter at Yahoo Finance, covering banking, crypto and other financial areas.

Click here for a detailed analysis of the latest stock market news and events affecting stock prices.

Read the latest financial and business news from Yahoo Finance