Fears of a 1970s-style recession and economic stagflation continue to engulf Wall Street and investors this week as multiple reports show recession signals have intensified. Reuters reports that due to rising oil and commodity prices, investors are “re-evaluating their portfolios in anticipation of an expected period of high inflation and weaker growth.”

While Wall Street fears stagflation, analyst believes ‘global markets will collapse’ this year

There have been plenty of headlines this week indicating that fears of a 1970s-style stagflation of the economy have intensified, with economic repercussions soon to come. Three days ago, Reuters writer David Randall noted that US investors are spooked by central bank hawkishness, rising oil prices and the current conflict in Ukraine. Randall spoke with Nuveen’s chief investment officer for global fixed income Anders Persson, and the analyst noted that stagflation is not yet, but it is approaching this point.

“Our base case is not yet the stagflation of the 1970s, but we are getting closer to that zip code,” Persson said.

On Saturday, Bitcoin.com news reported on energy stocks, precious metals and global commodities soaring, breaking market records. On the same day, popular Twitter account Pentoshi tweeted about the impending “Great Depression”. At the time of writing, tweet was retweeted 69 times and scored about a thousand likes. Pentoshi told his 523,500 Twitter followers:

The most interesting this year. There will be global markets collapsing. Any market that trades above 0 will be too high. They will call it the Great Depression, which will be 10 times worse than the Great Depression.

U.S. Treasury yield curve highlights ‘recession fears growing’

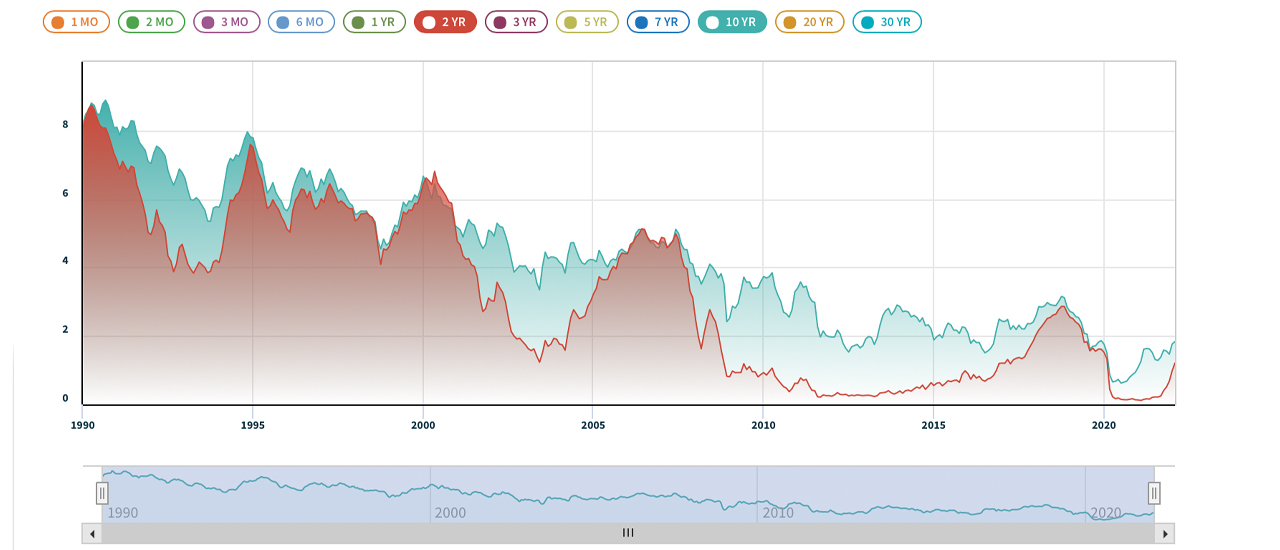

The next day, Reuters writer Davide Barbusha elaborated that “recession concerns are more prominent on the US Treasury yield curve.” Data from the Barbuscia report highlights that “the closely monitored gap between 2-year and 10-year yields is the narrowest since March 2020.”

U.S. 2- and 10-year Treasury yield curve via Nasdaq March 6, 2022

U.S. 2- and 10-year Treasury yield curve via Nasdaq March 6, 2022

Numerous financial publications highlight how rising oil and commodity prices are usually linked to an impending recession. Additionally, recent documents indicate that Warren Buffett’s Berkshire Hathaway has acquired a $5 billion stake in Occidental Petroleum. Berkshire Hathaway also doubled the firm’s stake in Chevron.

Tags in this story aluminum, Anders Persson, Berkshire Hathaway, Chevron, commodities, copper, David Randall, Davide Barbusha, economist, electricity prices, stocks, gold, NASDAQ, nickel, NYSE, Occidental Petroleum, OIL, Ounce of gold, Pentoshi, Recession, recession signals, Russia, S&P 500, silver, stagflation, equities, US Treasury yield curve, Ukraine, Warren Buffett, zinc

What do you think of the signals that the economy is in the recession or stagflation of the 1970s? Let us know what you think about it in the comments section below.

![]()

Jamie Redman

Image credits: Shutterstock, Pixabay, Wiki Commons

Denial of responsibilityA: This article is for informational purposes only. This is not a direct offer or solicitation to buy or sell, nor is it a recommendation or endorsement of any products, services or companies. Bitcoin.com does not provide investment, tax, legal or accounting advice. Neither the company nor the author is directly or indirectly liable for any damage or loss caused or alleged to be caused by the use of or reliance on any content, goods or services mentioned in this article.